4 ETFs That Can Supercharge Your Retirement Savings

The bear market has many investors looking for clever buys that can elevate their retirement portfolios above major index returns. It’s not reasonable to think that you’ll consistently outpace the market over the long term. However, there are some interesting exchange-traded funds (ETFs) out there which can accelerate growth or improve income yield, whatever your preference might be.

Vanguard Growth ETF

Younger investors generally prioritize growth in their retirement accounts, and the Vanguard Growth ETF (VUG 1.31%) might be the most straightforward and efficient growth-focused ETF on the market. This is a modified index fund that holds large-cap and mid-cap domestic stocks that pass six growth factor screens.

It currently holds 250 companies, with heavy exposure to large-cap technology and retail stocks. The fund is market cap weighted, making it heavily exposed to Apple, Alphabet, Microsoft, Amazon, and Tesla. These huge companies make up more than 40% of the portfolio.

The Vanguard Growth ETF has higher upside potential than the wider market, but it can experience excess volatility. This makes it appropriate for investors with long time horizons, but the ETF is less suitable for anyone with a short time horizon, such as people currently in retirement.

Image source: Getty Images.

The fund’s passive construction methodology and enormous scale allow it to charge a super-lean 0.04% expense ratio. It’s also highly liquid with a low bid-ask spread, so the cost of owning and trading this ETF is about as low as it gets. The Vanguard Growth ETF is dynamic as far as index funds go, but fairly vanilla as far as growth-focused ETFs go. It’s a great tool for passive investors who want some additional upside potential relative to the whole market.

iShares Exponential Technologies ETF

The iShares Exponential Technologies ETF (XT 1.56%) is a more aggressive play for growth investors. This fund invests across nine emerging technology themes, including artificial intelligence, robotics, nanotechnology, bioinformatics, data analytics, fintech, and cloud computing.

It owns companies from all over the world, including emerging markets. International stocks make up 40% of the allocation.

Instead of betting on a single company to flourish, this ETF allows investors to profit from global megatrends. It provides diversified exposure to disruptive tech leaders in high-growth industries that could define the coming decades. The allocation is equal-weighted, so smaller companies in the portfolio can influence results heavily. That’s helpful for growth investors who look for exponential returns.

The iShares Exponential Technologies ETF employs a fairly active methodology, which contributes to a fairly high 0.46% expense ratio. It has to deliver higher returns just to break even with passive funds, such as the Vanguard Growth fund. Exposure to mid-cap stocks and international companies also elevates volatility, which can magnify losses during market corrections.

iShares Core High Dividend ETF

Retirees and income investors are always looking for opportunities to increase yields without taking on too much risk, and the iShares Core High Dividend ETF (HDV 1.18%) is a great fund for that purpose.

This ETF holds 75 high-dividend-yield U.S. equities, which are screened for the presence of an economic moat, financial health, dividend sustainability, growth, and earnings quality. The portfolio is dividend weighted, in contrast to most of its peers, which are market cap weighted or yield weighted. This tends to skew the fund toward high-yield large-caps.

The management team’s goal is to create a portfolio that delivers high dividend yield without sacrificing quality, stability, or financial health — and it seems to be executing on that goal. The fund delivers a 4.4% distribution yield, which should keep income investors happy. While its proprietary investment selection process is somewhat involved, the fund still maintains a low 0.08% expense ratio, which is huge for anyone relying on income from their retirement fund.

The iShares Core High Dividend ETF does carry some concentration risk. Energy stocks, basic materials, consumer staples, and healthcare make up roughly 60% of the allocation. Its 10 largest holdings represent more than 50% of the fund. Unexpected bad news from a handful of companies or industries can have disproportionate effects on the fund’s performance.

Global X SuperDividend ETF

If you’re looking for a dividend ETF that’s off the beaten path, consider the Global X SuperDividend ETF (SDIV 3.82%). This fund maintains an equal weighted portfolio of 100 high-dividend stocks from around the world. The holdings are screened to exclude companies that are expected to slash or eliminate dividends, and the management team purchases the highest-yielding stocks that pass their sustainability screen. Only 30% of the companies are based in the U.S.

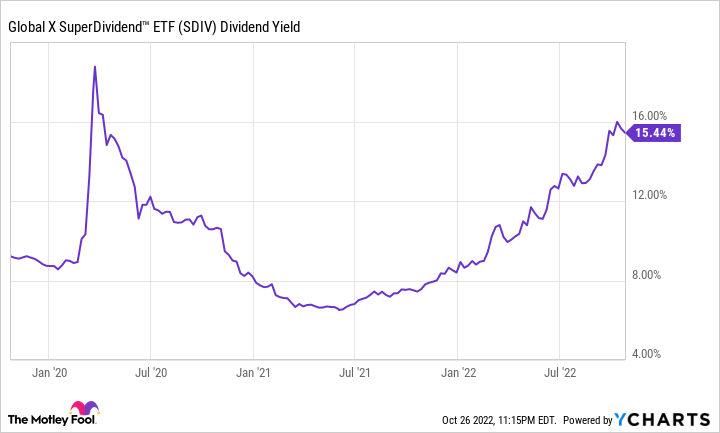

This approach leads to exceptionally high yield, which is currently above 15%. The ETF has consistently been among the higher-yield investments on the market, but that’s been exacerbated by this year’s market sell-off amid global economic uncertainty and currency fluctuations.

SDIV Dividend Yield data by YCharts

The ETF’s high yield comes hand-in-hand with extra volatility. Its 1.1 beta doesn’t look too bad on paper, but that’s high for a dividend investment. Retirees need to be diligent about managing volatility, so keep this in mind if you’re going to buy the Global X SuperDividend ETF.

It also carries concentration risk, with heavy exposure to the financial sector. Financial stocks are heavily influenced by macroeconomic conditions, and we’ve seen sectorwide havoc at times in the past. Don’t be shocked if this fund’s performance is highly cyclical, which is also undesirable for some income investors.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Ryan Downie has positions in Alphabet (A shares), Amazon, Global X SuperDividend ETF, Microsoft, and iShares Exponential Technologies ETF. The Motley Fool has positions in and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Microsoft, Tesla, and Vanguard Growth ETF. The Motley Fool recommends the following options: long March 2023 $120 calls on Apple and short March 2023 $130 calls on Apple. The Motley Fool has a disclosure policy.