Pi Ventures raises Rs 66 cr from British International Investment for second fund

Pi Ventures, which backs deep-tech and artificial intelligence startups with early-stage capital, has raised Rs 65.9 crore (about $8 million) from British International Investment (BII) for its second fund.

The investment by UK-based BII, a development finance institution, takes the corpus of Pi Ventures’ Fund-II to about Rs 530 crore, said Manish Singhal, one its founding partners.

Pi Ventures has backed startups like Agnikul, Niramai and Locus. It plans to make the final close of Fund-II by the first quarter of 2023, said Singhal. The fund had marked its first close at Rs 300 crore in January.

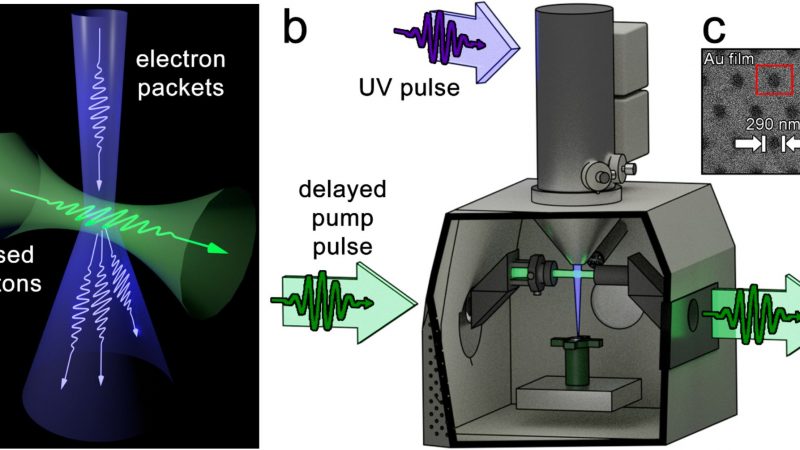

Singhal told ET that while Fund-I was focussed on companies offering AI-based solutions, Fund-II will focus on companies offering deep-tech solutions in the segments of blockchain, spacetech, biotech, artificial food and material science.

“There is some very interesting work happening in crypto infrastructure, in space-tech and nanotech,” Singhal said. “In Fund-II, we have built our thesis, which is quite broad in deep tech. We are now also looking at blockchain infrastructure use cases, material science-driven physical innovation, space-tech, artificial food, nanotech and biotech. It is a fairly broad spectrum now.”

Pi Ventures has already started closing investments from its latest fund. “We have been investing in parallel. We have done five investments already, and we are in very close conversations to do two more deals in the next couple of months,” Singhal said. “Our goal is to invest in 20-25 companies from this fund in the deep-tech segment.”

Discover the stories of your interest

He said one of the key tenets of the fund’s thesis is to invest in companies with a global market.

According to Singhal, Fund-II will continue to focus on seed to early-stage opportunities.

For Fund-II, Pi Ventures has set a base target of Rs 565 crore with a green shoe option of up to Rs 750 crore. “The maximum target for oversubscription is Rs 750 crore, and we expect to land somewhere between Rs 565 crore and Rs 750 crore,” Singhal said.

Pi Ventures plans to deploy Fund-II over the next two to three years. The fund is backed by Nippon India Digital Innovation AIF and Accel, in addition to family offices and entrepreneurs such as Flipkart cofounder Binny Bansal, Mamaearth cofounder Varun Alagh, People Group founder Anupam Mittal, MakeMyTrip founder Deep Kalra, and senior leaders from IBM, Facebook and Google, among others, the company said in a statement.

Its Fund-I, which was worth Rs 225 crore (or $30 million), was closed in 2018, backed 15 deep-tech startups, including Niramai, Pyxis, Wysa, Agnikul and Locus.

Meanwhile, as companies that received investment from Fund-I mature, Pi Ventures has started to plan exits from its portfolio.

“We have already exited one company from Fund-I through M&A. Exit possibilities are now increasing because our companies are now in the advanced stage,” Singhal said. “We expect meaningful exits coming for our investors 2024 onwards, and this will be through M&As and secondary transactions.”

Singhal said, “In that timeframe (by 2024-2025), we should get two strong exits in our portfolio, and we are very close to returning the fund.”

Even as the global macroeconomic downturn poses uncertainty on fundraising for Indian startups, several venture funds focused on the region have been raising record capital. Recently, early-stage investors Axilor Ventures and Athera Venture Partners (formerly Inventus India) launched their funds.

Even prominent venture investors, including Accel, Elevation Capital and Sequoia Capital, have raised record capital to back opportunities in the region.