15 Biggest Nanotechnology Companies in the World

If there is one industry that often sounds as if it is in the realm of science fiction, it is nanotechnology. Nanotechnology is the use of materials science industrially involving matter whose dimensions range between one nanometer to 100 nanometers. For reference, a single strand of a human hair ranges anywhere between 80,000 to 100,000 nanometers, so nanotechnology, by definition, involves manipulating matter to sizes that are up to 100,000 times smaller than a hair on your head.

Owing to the advantages offered by this unique manipulation, nanotechnology is adopted in a variety of different industries. These include construction, healthcare, and energy. In the construction industry, these technologies are used to create new materials that are durable and provide lucrative benefits such as water resistance, corrosion protection, and even self cleaning. Another widely popular application is the semiconductor industry, which has successfully created transistors that are now as small as 3 nanometers. Healthcare is another segment that benefits from nanotechnology, as nanotubes, owing to their small size, are effective fighters against cancer cells. These treatments involve injecting the nanotubes in the vicinity of cancer cells, and once they are bombarded with lasers, they generate heat that ends up killing the cancer cells. Nanoparticles are also used to bypass the blood-brain barrier due to their small size.

Moving towards the industry itself, and growth estimates, the nanotechnology sector is projected to strongly grow due to its novelty and relatively nascent nature. For instance, a research report from Valuates Reports believes that the nanotechnology market was worth $1.76 billion in 2020 and it will grow at a compounded annual growth rate (CAGR) of 36.4% between then and 2030 to be worth $33.63 billion by the end of the forecast period. The firm also believes that healthcare will be the largest segment, and nanodevices will be the most lucrative product category. Furthermore, it also outlines that Asia Pacific industry segment will grow at 40%, to outpace the overall industry trend, and the aerospace and defense sector will be the fastest growing user with a whopping 43.4% CAGR.

Another report, this time from Atlantic Market Research, estimates a 13.6% CAGR for the nanotechnology market. According to the research firm, the industry will be worth $11.7 billion in 2023. Atlantic Market Research also outlines that electronic applications will hold a 27% market share of the nanotechnology market from 2021 to 2030. It adds that North America held a 21% market share of the nanomaterials market in 2020, and a 38% share of the broader nanotechnology market during the same year.

Finally, Precedence Research has the largest estimate for the future value of the nanotechnology market. This research firm believes that the industry was worth $85 billion in 2021, and it will grow to a stunning $288 billion by 2030 through a 14.5% CAGR. Precedence Research also believes that as of May 2022, 20,000 nanotechnology researchers were working in the United States, and despite this, China will be the largest player in the future as well in addition to holding a 35% market share in 2021. Some key trends for the sector include semiconductors and electronics, while hurdles include the difficulties of scaling up the production of the products. These include the recent chip shortages that have created difficulties for both personal computing and automotive markets recently.

Today’s piece will focus on companies that work in the nanotechnology industry, and it ranges from those that provide the products and services to those that provide backend support. Top players include International Business Machines Corporation (NYSE:IBM), Intel Corporation (NASDAQ:INTC), and Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM).

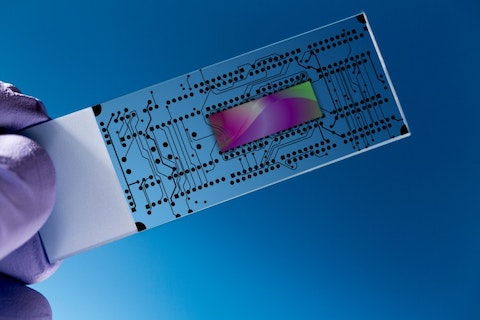

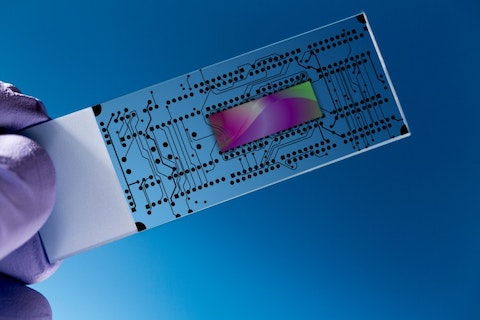

science photo/Shutterstock.com

Our Methodology

We took a look at several industries such as chip fabrication, healthcare, and industrials to determine which companies use nanotechnology. They are ranked through their market capitalization.

15. Veeco Instruments Inc. (NASDAQ:VECO)

Market Capitalization as of December 6, 2022: $982.74 million

Veeco Instruments Inc. (NASDAQ:VECO) is an American firm that sells semiconductor manufacturing equipment. The firm is headquartered in Plainview, New York.

Veeco Instruments Inc. (NASDAQ:VECO) sells wafer processing, deposition, and packaging lithography machines. The firm’s products are used to manufacture memory chips, logic devices, hard disk drives, and power management controllers. Veeco Instruments Inc. (NASDAQ:VECO) also has a nanotechnology research center in Beijing, China.

As part of their Q3 2022 investments, 15 out of the 920 hedge funds polled by Insider Monkey had held a stake in Veeco Instruments Inc. (NASDAQ:VECO).

Veeco Instruments Inc. (NASDAQ:VECO)’s largest shareholder in our database is Ken Fisher’s Fisher Asset Management which owns 928,427 shares that are worth $17 million.

14. Coherent Corp. (NASDAQ:COHR)

Market Capitalization as of December 6, 2022: $4.83 billion

Coherent Corp. (NASDAQ:COHR) is a technology equipment firm with products such as lasers, optical assemblies, transceivers, and pump lasers. The company is headquartered in Saxonburg, Pennsylvania.

Coherent Corp. (NASDAQ:COHR)’s products such as its laser optical systems are used in nanotechnology manufacturing technologies such as freeform nanotechnology surfacing to customize designs according to the use case. The company reported $1.34 billion in revenue for its first fiscal quarter of 2023 marking 69% annual growth.

By the end of this year’s third quarter, 36 out of the 920 hedge fund portfolios studied by Insider Monkey had invested in Coherent Corp. (NASDAQ:COHR).

13. PPG Industries, Inc. (NYSE:PPG)

Market Capitalization as of December 6, 2022: $31.03 billion

PPG Industries, Inc. (NYSE:PPG) is an American materials firm that is based in Pittsburgh, Pennsylvania. The company sells coatings, solvents, and adhesives for the aviation, construction, and automotive industries among others.

PPG Industries, Inc. (NYSE:PPG) uses advanced nanotechnology to manufacture vacuum and polymer coatings for the aerospace industry. These provide erosion resistance, night vision compatibility, ultraviolet light blocking, and electromagnetic shielding.

Insider Monkey’s September quarter of 2022 study of 920 hedge funds outlined that 34 had bought PPG Industries, Inc. (NYSE:PPG)’s shares.

PPG Industries, Inc. (NYSE:PPG)’s largest investor is Brandon Haley’s Holocene Advisors which owns 1.1 million shares that are worth $126 million.

12. DuPont de Nemours, Inc. (NYSE:DD)

Market Capitalization as of December 6, 2022: $34.76 billion

DuPont de Nemours, Inc. (NYSE:DD) is a materials manufacturer that services the needs of different industries such as semiconductor manufacturing, display production, transportation, and renewable energy. It is also one of the oldest companies in the world which traces its roots back to 1802.

Nanotechnology is essential to DuPont de Nemours, Inc. (NYSE:DD)’s business and the firm is an active participant in developing new areas in this segment through its research and development division. Some use cases include electromagnetic shielding, thermal management, bonding, and energy efficiency.

By the end of this year’s third quarter, 45 out of the 920 hedge funds polled by Insider Monkey had invested in DuPont de Nemours, Inc. (NYSE:DD).

Out of these, David S. Winter and David J. Millstone’s 40 North Management is DuPont de Nemours, Inc. (NYSE:DD)’s largest investor through a $336 million stake that comes via 6.6 million shares.

11. Cadence Design Systems, Inc. (NASDAQ:CDNS)

Market Capitalization as of December 6, 2022: $44.90 billion

Cadence Design Systems, Inc. (NASDAQ:CDNS) is a backend semiconductor firm. Its products allow chipmakers to verify their products post-production and use generic integrated circuit design blocks.

Cadence Design Systems, Inc. (NASDAQ:CDNS)’s tools sit at the heart of chip manufacturing. They let manufacturers complete design projects on time and automate their design processes as well.

46 hedge funds out of the 920 surveyed by Insider Monkey during Q3 2022 had bought Cadence Design Systems, Inc. (NASDAQ:CDNS)’s shares.

Cadence Design Systems, Inc. (NASDAQ:CDNS)’s largest investor is Panayotis Takis Sparaggis’s Alkeon Capital Management which owns 3.2 million shares that are worth $523 million.

10. Synopsys, Inc. (NASDAQ:SNPS)

Market Capitalization as of December 6, 2022: $49.98 billion

Synopsys, Inc. (NASDAQ:SNPS) is an electronic design automation software provider. Its products are used in the semiconductor industry.

Synopsys, Inc. (NASDAQ:SNPS)’s products have solved a host of different problems that chipmakers have faced in the nanotechnology era. These include timing closure, yield and test designs, signal integrity, and power consumption. Additionally, its QuantumATK Atomistic Simulator enables firms to simulate their material performance at the nanometer level.

Insider Monkey took a look at 920 hedge fund portfolios for Q3 2022 to discover that 42 had invested in Synopsys, Inc. (NASDAQ:SNPS).

Out of these, Synopsys, Inc. (NASDAQ:SNPS)’s largest investor is Panayotis Takis Sparaggis’s Alkeon Capital Management which owns 1.9 million shares that are worth $587 million.

9. 3M Company (NYSE:MMM)

Market Capitalization as of December 6, 2022: $66.86 billion

3M Company (NYSE:MMM) is a technology firm that offers products to the industrial, transportation, electronics, healthcare, and consumer industries. The firm is based in St. Paul, Minnesota.

3M Company (NYSE:MMM) uses nanotechnology for several purposes, including dental products. Its dental fillings and restoratives use nanomaterials that end up mimicking the tooth’s enamel to settle down smoothly.

49 of the 920 hedge funds profiled by Insider Monkey for their September quarter of 2022 investments had held a stake in 3M Company (NYSE:MMM).

3M Company (NYSE:MMM)’s largest investor is Ken Fisher’s Fisher Asset Management which owns 6.3 million shares that are worth $703 million.

8. Analog Devices, Inc. (NASDAQ:ADI)

Market Capitalization as of December 6, 2022: $84.80 billion

Analog Devices, Inc. (NASDAQ:ADI) is a semiconductor firm that manufactures and sells signal conversion products, power devices, and sensors. It is based in Wilmington, Massachusetts.

Analog Devices, Inc. (NASDAQ:ADI) also sells the nanoDAC and the nanoDAC+ family of products. These are digital to analog converters which are used in applications such as music players to convert digitally stored songs into analog music output.

Insider Monkey researched 920 hedge funds during this year’s third quarter and found out that 66 had bought Analog Devices, Inc. (NASDAQ:ADI)’s shares.

David Blood and Al Gore’s Generation Investment Management is Analog Devices, Inc. (NASDAQ:ADI)’s largest investor through a $694 million stake that comes via 4.9 million shares.

7. Applied Materials, Inc. (NASDAQ:AMAT)

Market Capitalization as of December 6, 2022: $91.35 billion

Applied Materials, Inc. (NASDAQ:AMAT) is an American firm that develops products for semiconductor fabrication.

Applied Materials, Inc. (NASDAQ:AMAT) has partnered up with several universities to research the use of nanotechnology in semiconductor manufacturing and healthcare applications. Its products manipulate materials at the atomic level in processes such as atomic layer deposition and ion implant.

67 of the 920 hedge funds covered by Insider Monkey for their Q3 2022 investments had bought Applied Materials, Inc. (NASDAQ:AMAT)’s shares.

Applied Materials, Inc. (NASDAQ:AMAT)’s largest investor is David Blood and Al Gore’s Generation Investment Management which owns 6.7 million shares that are worth $549 million.

6. General Electric Company (NYSE:GE)

Market Capitalization as of December 6, 2022: $98 billion

General Electric Company (NYSE:GE) is an American company that provides steam turbines, wind turbine blades, aircraft engines, and other products.

General Electric Company (NYSE:GE) is an active player in nanotechnology research, which is studying different use cases such as using nanoparticles for heart disease and cancer diagnostics and the tendency of nanomaterials to self organize themselves into electrical circuits.

By the end of this year’s third quarter, 53 of the 920 hedge funds polled by Insider Monkey had held a stake in General Electric Company (NYSE:GE).

General Electric Company (NYSE:GE)’s largest hedge fund shareholder is Richard S. Pzena’s Pzena Investment Management which owns 13.7 million shares that are worth $851 million.

General Electric Company (NYSE:GE) is one of the largest nanotechnology firms in the world, alongside others such as International Business Machines Corporation (NYSE:IBM), Intel Corporation (NASDAQ:INTC), and Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM).

Click to continue reading and see 5 Biggest Nanotechnology Companies in the World.

Suggested Articles:

Disclosure: None. 15 Biggest Nanotechnology Companies in the World is originally published on Insider Monkey.